New challenges in the alternative investment world

Alternative investment fund management is experiencing a period of intense changes in line with macroeconomic developments, and this is affecting both private market fund structures and operating models.

Since 2022, alternative investment fund (“AIF”) management has faced an increasing complexity due to a great number of factors, namely an uncertain geopolitical context, a higher economic risk in several sectors, a higher difficulty in executing traditional exit strategies (e.g. a slowdown in IPOs1), the rising rates (March 2022 to July 2023 saw an average cumulative rise of over 525 points in the US, EUR and UK zones2), and the tightening of financial belts in the private sector (private market fundraising fell by 22% on the global market in 20233).

As a result of these statements, the AIF industry is shifting to a more diversified model:

On the assets side, investments are progressively moving towards private debt as well as towards more traditional investments such as listed shares and bonds;

On the liabilities side, AIFs are becoming more accessible to attract retail clients into private equity investments.

A strong growth in private debt investments

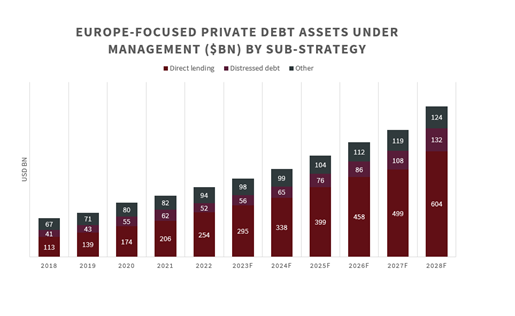

Loans have become the most attractive assets for AIFs at a global level, experts are expecting private debt to raise funds around USD 3,500 billion by 2028, while in Europe it is estimated that the private debt market will grow by more than 200% between 2022 and 20284.

In addition to a more appreciable and consistent profitability, driven by rising rates on the main markets and more regular liquidity flows, the variety of debt products allows to have a wide choice of investments suitable for different fund strategies.

Funds can choose to originate or participate in loans that finance primarly offerings from private companies (the private equity approach), or to select loans on a secondary market. For more effective interest-rate strategies, funds can also add listed bonds and derivatives to their portfolios.

These choices are made possible by:

Relaxed regulations that are supposed to encourage non-bank financing in the real economy. For example, ELTIF 2 allows funds to hold 45% in listed products, whereas AIFMD 25 clarifies the rules for AIF loan origination within the European Union.

Changes to the ecosystem: including the development of “loan administration” functions to lighten the load on fund-level loan monitoring, or, moreover, the move towards greater transparency in the secondary market as a result of the platformisation (the WSO network in particular).

These adaptations will have a lasting effect on how the AIF industry develops, bringing greater flexibility and tools to help the sector adapt to steady market changes. Funds will hold onto their expertise in the private sector while moving closer to more traditional asset management. The regulatory framework will also permit greater leeway in fund structuring. For instance, under AIFMD 2 the threshold for investment in private loans only accounts for 50% for an AIF wishing to be classified as a “loan origination fund”.

Opening up to retail customers

On the liabilities side, the same trends for a greater flexibility and accessibility have been recorded. Asset managers and regulators are gradually turning to a retail customer base to broaden long-term funding sources for private companies and the economy overall.

The ELTIF 2 regulation gives a clear signal of this shift by completely removing the investment threshold for retail investors. ELTIFs can also use a European Union marketing passport for this purpose.

As they distance themselves from traditional closed-ended funds, fund managers are working on their new marketing strategies, by enhancing the emphasis on partnerships with some distribution channels such as private banks. Digitalising product offerings has also become a necessity to promote access for retail customers.

This also means changing product structures to meet the more stringent liquidity requirements for retail customers. As a result, we are seeing more and more portfolio compartments dedicated to liquid assets and the introduction of liquidity mechanisms (such as “gates” and “anti-dilution levies”) historically used by UCITS funds for subscriptions and redemptions. These usages of liquidity tools is even ”imposed” by AIFMD 2 regulations.

These trends are, furthermore, driving profound changes throughout the AIF management ecosystem. Platforms such as Goji and AirFund, for example, have been acquired by fund industry giants (Euroclear and Amundi respectively), targeting consolidation in private fund distribution and processing.

Asset servicers undergoing transformation

A question is emerging among fund administration service providers: how can we better equip ourselves in order to support alternative funds that are evolving in terms of both their investments and their marketing methods? There are two challenges to be faced: one is technological, to contribute to the sector’s industrialisation (in connection with platforms, investor volumes, etc.) and the second one is organisational, to enhance our service offering (with new loan administration functions and liquidity management tools).

Here at Societe Generale Securities Services in Luxembourg, we’re backed by our stable institutional customer base, and we’ll continue to reflect on these topics, as well as to work together to create innovative services tailored to our customers’ needs. We’ll build all this while maintaining our current expertise both as a custodian bank offering cash solutions and as a central administrator for alternative funds.

1In 2023, the international market saw 1,298 IPOs, raising a total of USD 123.2 billion. This represents a fall of 8% in volume and 33% in the total amount raised compared to 2022 (source: Café de la Bourse).

2Source: Bain & Company

3Source: “McKinsey Global Private Markets Review 2024: Private markets in a slower era”.

4Source: Prequin

5Transposition scheduled for 2026

Yang Qing, Head of Alternative Funds Services (Luxembourg), Societe Generale Securities Services