Success of the wholesale Central Bank Digital Currency trial by the Eurosystem with Societe Generale

At the request of the management company Ofi Invest AM and the insurer Generali France, Societe Generale participated, from April to November 2024, in the projects led by the Banque de France and the European Central Bank (ECB) concerning the use of a wholesale Central Bank Digital Currency (wCBDC), i.e. “exploratory” euro cash tokens, for the settlement of financial transactions involving tokenised securities (security tokens).

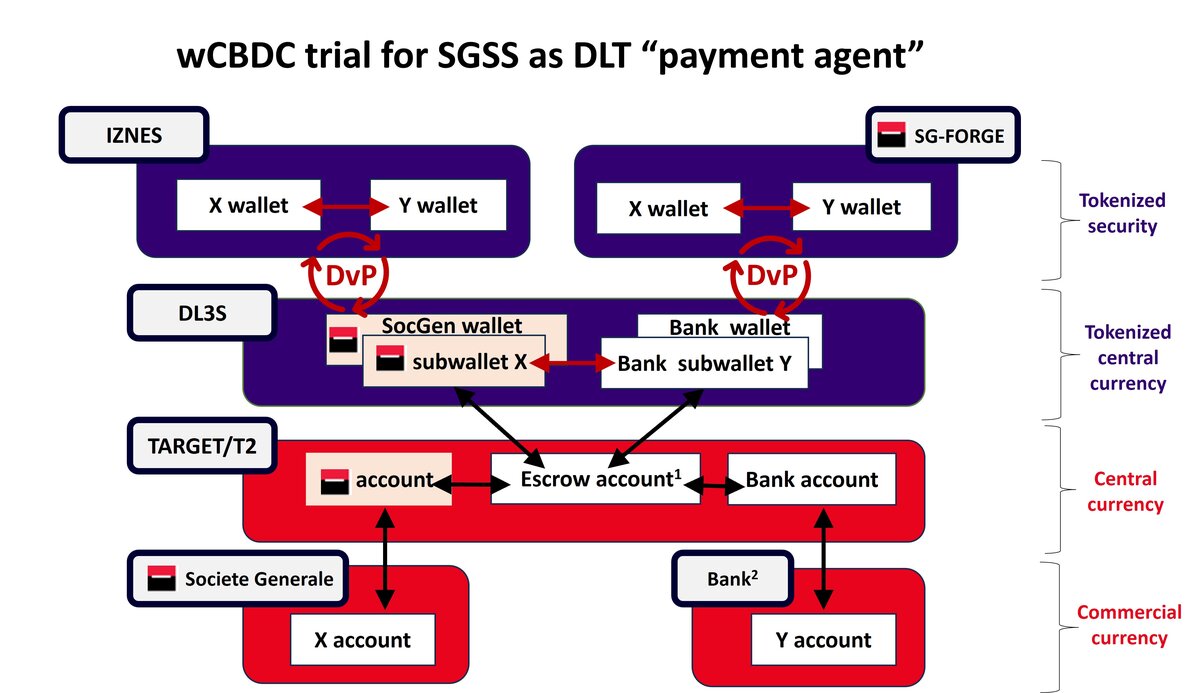

The main objective of the experiment was to process DvP (Delivery versus Payment) transactions based on interoperability between the Banque de France's DL3S blockchain for the euro cash token component and external blockchains for the security token component (see diagram below). In particular, the experiment involved transactions on the assets and liabilities sides of Ofi Invest AM's tokenised funds, whose register was held in the private blockchain operated by IZNES. Making euro cash tokens available in DL3S for OFI Invest AM and Generali France required the contribution of a paying agent, a role assigned to Societe Generale Securities Services (SGSS).

The experiment consisted of Generali France investing in a first Ofi Invest AM tokenised fund, which then invested in a second Ofi Invest AM tokenised fund and in a tokenised bond issued by Societe Generale via another blockchain, this time public and operated by Societe Generale-FORGE. The tokenised securities acquired in this way were then bought back or redeemed a few days later, but always in euro cash tokens. These tokenised securities were deemed to be held in registered form, i.e. in the direct custody of the issuers of these securities. The objective was an ambitious one, since it involved real transactions. The challenge for SGSS was to successfully reconcile the old and new settlement/delivery circuits without adding operational risk and without calling into question existing movements and patterns in commercial bank money.

The trial ended successfully for all participants on 20 November, demonstrating the feasibility of an entirely digital world of collective investment management, on both the assets and liabilities sides of the funds.

In addition to the Banque de France model, the ECB is monitoring other security token DvP models offered by two other national central banks (Bundesbank and Banca d'Italia). It plans to produce a summary of these models in 2025 and to issue guidelines if necessary. The models offered by these central banks could therefore evolve further1.

1Oral Banque de France source.

1 The ‘escrow’ account created by the Banque de France in T2 is an escrow account which reflects the euro cash tokens circulating in DL3S. Any inflow or outflow of euros in this escrow account is therefore associated with a creation/destruction of euro cash tokens in DL3S

2 At the request of the Banque de France and in order to minimise the operational risks of the experiment, Societe Generale's counterparty in the experiment was Societe Generale itself. As a result, the amount transferred at the end of the day by the Banque de France via its escrow account to Societe Generale's T2 account was always deemed to be equal to the amount transferred at the beginning of the day by Societe Generale's T2 account to this escrow account.