2027 and the shift towards T+1 in Europe

Shortening the settlement cycle is a recurring process – veteran bankers will remember the arrival of D+5 in France in the 1990s, replaced by D+3 and then T+2 in 2014. Such a shift is natural, and it follows the industry’s progress in automation, rationalization, and harmonization. So how is this new iteration such a big challenge?

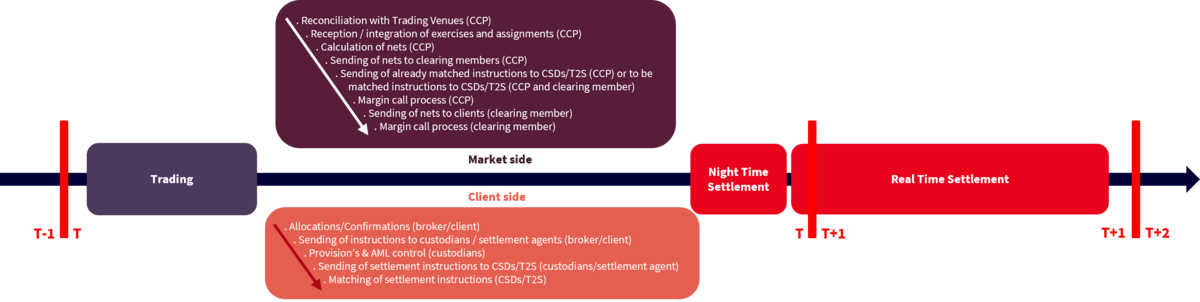

Until now, time compression has been measured in days; this time, the unit of measurement is hours. With T+1, all the steps between executing a transaction and being supported by a CSD1 should be performed in a few hours.

Indeed, a transaction concluded on T will have until T+1 +/- 4pm to settle, so one might be tempted to dismiss such constraints as “unnecessary” and consider the value of forcing everything in just a few hours. But this would be to forget the important role played by the night cycle (for the CSDs that propose it) in the overall process. In its most advanced version, this is the time in the “Settlement day2” when optimization is strongest. The industry has understood this and has made the non-degradation of the current process the starting point.

Where do we stand?

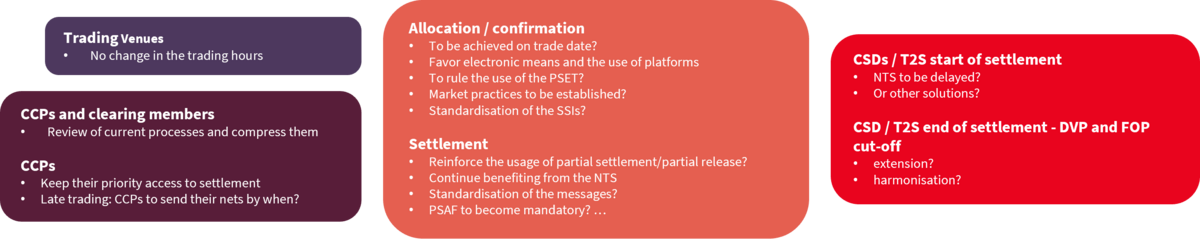

Several working groups have been set up to better understand the impact of the T+1 and to define the prerequisites, adaptations or changes to be made beforehand. While many ideas have emerged from this work, they are still in the form of proposals and even questions, as each link in the chain of post-market actors will have to be able to rely on others to be able to move to T+1. What is the point of a settlement process without instructions? Favor Affirmation Platforms? Why not, but on the condition that they take up at their level the matching criteria applied by the CSDs3...

Eyes on 2027?

Propelled to the forefront - probably echoing announcements across the Channel3-, 2027 has become the watchword, the starting point for a retroplan that the industry (including infrastructures) should establish. If it is necessary to set a date quickly because it gives visibility and priority to other work, it is still necessary to do it once the first elements are in hand (the order of magnitude of the adaptations, the division between the “nice to have” and the “must have” In the latter category, mention may be made of the scope of transactions which would be subject to the requirement of a settlement at T+1. To move forward, the industry has assumed that it would be the same as the switch to T+2 in 2014, but we cannot be sure of that today. A difference could call into question certain conclusions.

Alignment with the UK (tipping over to the same date) is put forward to explain the focus of 2027 and undoubtedly the coexistence of two settlement cycles will have consequences. But what matters is a successful switch, and it is difficult to say right now whether 2027 is achievable or not (the report5 of the EU T+1 industry TF clearly indicates there were mixed views on the 2027 feasibility and concludes “Generally, it may be more appropriate to determine the implementation date by first defining the necessary transition period. The time needed will depend on the changes deemed as necessary, and will require careful consideration on the sequencing of such changes. Initial suggestions as to the appropriate duration of such period range from 24 to 36 months”. It is worth noting that it will have taken the US a little over three years (and perhaps enough for the UK) to shift to a single market and therefore question the feasibility of the same timeframe in the context of almost 30 markets and associated infrastructure.

Above all, setting a date without having all the elements could lead to a situation where the accepted adaptations would be “minimal” versions (the part that would hold within the time allowed) with the risk of moving to T+1 in a situation requiring manual interventions, tools and processes that are not completed. Settlement efficiency after the noticed efforts of the industry following the implementation of CSDRs could actually be degraded by such a decision.

At the very least, in order to plan for 2027, it is becoming urgent to have certainty and to implement governance that brings all post-market components together around the table.

Unlike its predecessors, this new shortening can be achieved only if all players contribute their part. The T+1 shift’s motto could then be summarised by Alexandre Dumas’ Trois Mousquetaires’ rallying call “One for all, all for one” (and potentially having also the UK on board).

1CSD : Central Securities Depository

2The settlement day starts the day prior to the agreed deadline

3CSDR: Central Securities Depositories Regulation (2014/909) on improving securities settlement in the European Union and on central securities depositories

4In particular in the « Geffen » report : Accelerated_Settlement_Taskforce_Report.pdf (publishing.service.gov.uk)

5www.afme.eu/publications/reports/details/high-level-roadmap-for-adoption-of-t1-in-eu-securities-markets